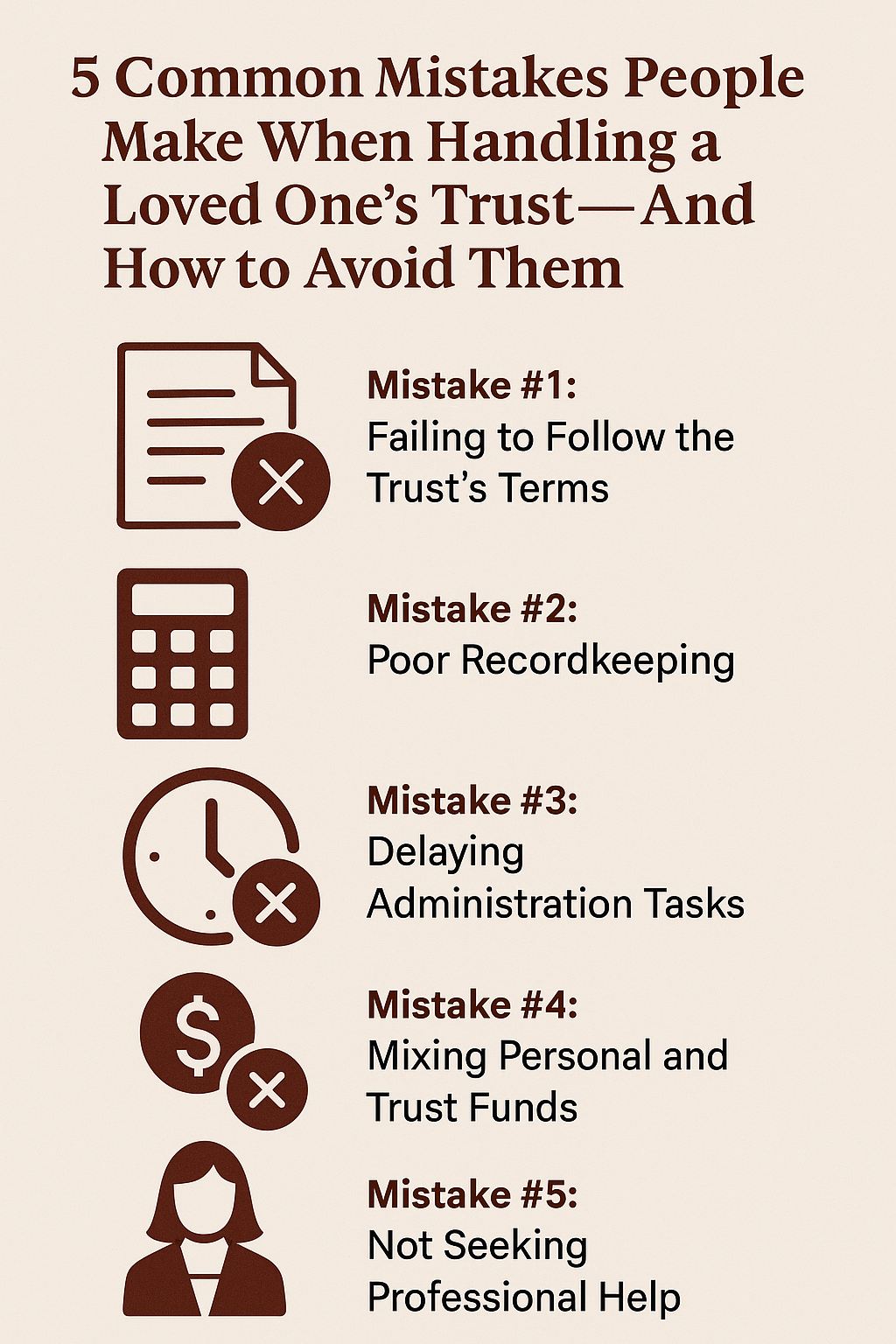

5 Common Mistakes People Make When Handling a Loved One’s Trust—And How to Avoid Them

Acting as a trustee can be a heavy responsibility, especially during a time of grief. Unfortunately, many well-meaning individuals make costly errors. At Redwood Trust and Probate, we’re here to help you avoid common missteps.

Mistake #1: Failing to Follow the Trust’s Terms

Every trust has specific instructions. Skipping or misinterpreting them—no matter how well-intentioned—can lead to legal disputes or breach of fiduciary duty.

Avoid It: Always consult with an estate attorney or professional fiduciary to ensure compliance.

Mistake #2: Poor Recordkeeping

Trustees are required to keep accurate records of all financial transactions. Disorganized or incomplete records can raise red flags with beneficiaries or the court.

Avoid It: Keep detailed logs, receipts, and accounting for every action you take as trustee.

Mistake #3: Delaying Administration Tasks

Trustees often postpone trust administration, especially when grieving. However, delays can cause complications—like missed deadlines, lapsed insurance, or tax issues.

Avoid It: Set a realistic timeline and seek help early to avoid being overwhelmed.

Mistake #4: Mixing Personal and Trust Funds

Even small, accidental mixing of funds is a violation of fiduciary duty and can open you up to liability.

Avoid It: Open separate trust bank accounts and never co-mingle personal assets.

Mistake #5: Not Seeking Professional Help

Many trustees underestimate the complexity of the role and try to manage it alone. This can lead to mistakes, legal trouble, and family tension.

Avoid It: Hire a professional fiduciary like Redwood Trust and Probate to ensure proper, neutral administration.